Leases used to be simple. You rented an office. Maybe some equipment. Paid monthly. Wrote it down. Done. Then accounting rules changed. Now leases sit on balance sheets. Numbers matter more. Dates matter more. One small mistake? Big reporting trouble. That’s where lease accounting software comes in. If you manage leases using spreadsheets today, you already know the pain. Files everywhere. Dates missed. Calculations double-checked again and again. Auditors asking questions you’re not fully sure about.

This guide breaks down the best lease accounting software. What it does, why companies need it, who should use it, what features actually matter and how to choose the right one without overpaying or overcomplicating things.

No jargon. No sales talk. Just real help.

What Is Lease Accounting Software?

Lease accounting software helps businesses track, calculate, and report leases correctly under modern accounting rules.

Instead of manual spreadsheets, the software:

- Stores all lease details

- Calculates liabilities and assets

- Tracks payments and changes

- Creates audit-ready reports

It turns messy lease data into clean numbers.

Most importantly, it helps companies follow rules like:

- ASC 842

- IFRS 16

Without this software, compliance becomes slow, risky, and stressful.

Why Lease Accounting Software Is Now Essential

Accounting rules changed how leases are treated.

Before:

- Operating leases stayed off the balance sheet

- Reporting was lighter

Now:

- Most leases must appear on the balance sheet

- Right-of-use assets and lease liabilities are required

- Disclosures are detailed and strict

This shift made manual tracking almost impossible for growing companies.

Lease accounting software exists to:

- Reduce compliance risk

- Save time

- Avoid reporting errors

- Make audits smoother

For many finance teams, it’s no longer optional.

Who Needs Lease Accounting Software?

More businesses need this than they realize.

Companies With Multiple Locations

Retail chains, restaurants, offices, warehouses. Each lease adds complexity.

Equipment-Heavy Businesses

Companies leasing vehicles, machinery, medical equipment, or IT assets.

Growing Startups

Scaling fast means signing leases fast. Tracking manually doesn’t scale.

Public Companies

Strict reporting standards make automation necessary.

Private Companies Preparing for Audit or Sale

Clean lease data increases trust and valuation.

If your company has more than a handful of leases, software saves real money and time.

What Good Lease Accounting Software Actually Does

Not all tools are equal. The best ones focus on a few core jobs.

Central Lease Storage

All leases live in one place. Contracts. Dates. Terms. No hunting through emails or folders.

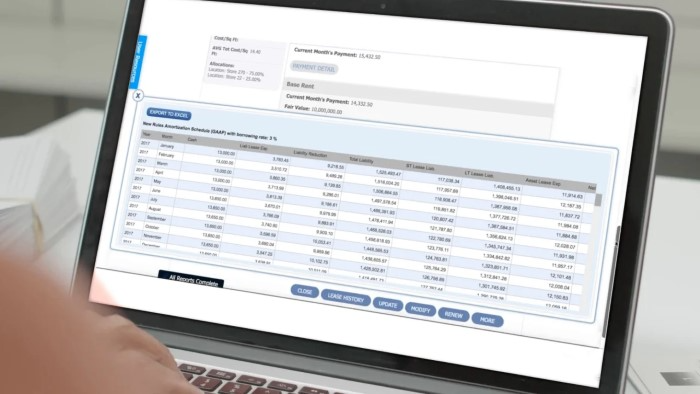

Automatic Calculations

The software calculates:

- Lease liabilities

- Right-of-use assets

- Interest and amortization

- Monthly and yearly balances

No manual formulas. No guesswork.

Compliance Handling

It applies the correct accounting standard automatically based on your settings.

Payment Tracking

Tracks rent schedules, escalations, and changes over time.

Modifications and Reassessments

Handles renewals, term changes, remeasurements, and early terminations.

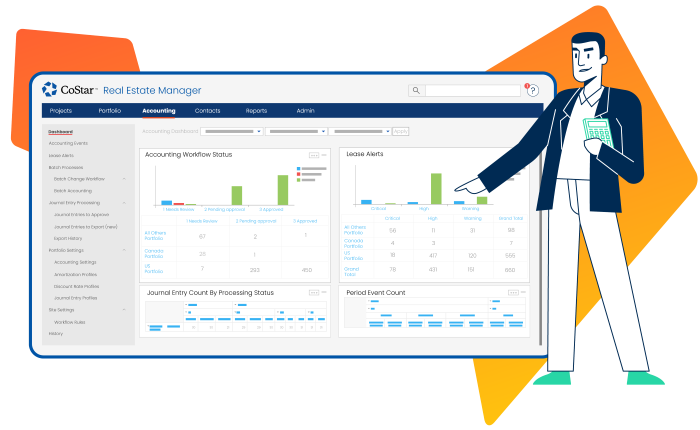

Reporting and Disclosures

Creates audit-ready reports with a few clicks.

That’s the core value. Everything else is extra.

Key Features to Look For in the Best Lease Accounting Software

When comparing options, focus on features that actually matter.

Compliance Support

The software must fully support ASC 842 and IFRS 16. Partial support is risky.

Ease of Use

Finance teams should not need weeks of training. Clean interface matters.

Import From Spreadsheets

Most companies start with Excel. Easy migration is important.

Audit Trail

Every change should be logged. Auditors love this.

Scenario Handling

Ability to model changes before committing them.

Integration With Accounting Systems

Smooth sync with ERP or accounting software saves hours.

Security and Access Control

Lease data is sensitive. Permissions matter.

Fancy dashboards are nice. Solid fundamentals are better.

Why Spreadsheets Fail at Lease Accounting

Spreadsheets feel cheap. But they cost more over time.

Common problems:

- Formula errors

- Missed renewal dates

- Broken links

- Version confusion

- No audit trail

- Hard to scale

One mistake can:

- Misstate financials

- Delay audits

- Trigger compliance issues

Lease accounting software reduces human error dramatically.

Cloud-Based vs On-Premise Lease Accounting Software

Most modern tools are cloud-based.

Cloud-Based Software

- Access anywhere

- Automatic updates

- Easier collaboration

- Faster setup

On-Premise Software

- More control

- Higher setup cost

- Maintenance required

For most companies today, cloud-based solutions make more sense.

How Lease Accounting Software Helps During Audits

Audits are where the value really shows.

Instead of scrambling:

- Auditors get clear reports

- Calculations are transparent

- Changes are documented

- Supporting documents are linked

This reduces:

- Audit time

- Back-and-forth questions

- Stress on finance teams

Many companies recover the software cost in saved audit hours alone.

Lease Accounting Software for Small vs Large Businesses

Size matters when choosing software.

Small Businesses

Need:

- Simple setup

- Affordable pricing

- Core compliance features

- Easy learning curve

Overly complex systems become unused.

Large Enterprises

Need:

- Scalability

- Multi-entity support

- Advanced reporting

- Strong integrations

Choosing the wrong size tool creates frustration on both ends.

Common Mistakes Companies Make When Choosing Lease Accounting Software

These mistakes cost time and money.

Buying Too Much Software

Paying for features you’ll never use.

Ignoring Ease of Use

A powerful tool nobody uses is useless.

Underestimating Data Cleanup

Bad input data leads to bad results.

Not Involving Auditors Early

Auditor expectations matter.

Delaying Implementation

Waiting too long increases risk.

Good planning avoids most of these problems.

How Long Does Implementation Take?

It depends on:

- Number of leases

- Data quality

- Team readiness

Rough timelines:

- Small setups: a few weeks

- Medium companies: one to two months

- Large portfolios: several months

Clean data speeds everything up.

Lease Accounting Software and Ongoing Maintenance

This is not a one-time task.

Ongoing work includes:

- Adding new leases

- Updating modifications

- Reviewing reports

- Monitoring renewals

Good software makes maintenance light and predictable.

Bad software makes it painful.

Costs: What You’re Really Paying For

Pricing varies widely.

Costs usually depend on:

- Number of leases

- Features included

- Support level

- Integrations

Remember:

Cheap software that causes errors is expensive.

Reliable software that saves time pays for itself.

Focus on value, not just price.

How Lease Accounting Software Improves Decision Making

Beyond compliance, good software helps leaders decide better.

You can:

- See total lease exposure

- Compare lease vs buy options

- Understand long-term obligations

- Plan cash flow better

This turns lease data into strategy, not just reporting.

Signs You’re Ready for Lease Accounting Software

You probably need it if:

- You manage leases in Excel

- Audits take too long

- You struggle with ASC 842 or IFRS 16

- Lease data lives in many places

- Renewals catch you by surprise

These are clear warning signs.

Future of Lease Accounting Software

Space is still evolving.

Trends include:

- More automation

- Better integrations

- AI-assisted data extraction

- Cleaner reporting

Software will keep reducing manual work.

Lease accounting got complicated. Software made it manageable. The best lease accounting software doesn’t just check a compliance box. It saves time. Reduces risk. Makes audits easier. And gives clarity where spreadsheets fail. The right tool depends on your size, lease volume, and needs. But doing nothing is usually the worst option. If leases are part of your business, proper software turns a constant headache into a controlled, predictable process.